Ever Wonder How Money Was Created? (If you guessed the Fed or the Mint, you're wrong)

The 7 Most Important Economic Events of 2007

Read the Full Article Here

World Abandoning US Dollar as Standard for International Trade

Excerpt:

The foreign exchange markets are not solely about exchange rates. They are about values, smooth flowing of international trade, about trust and reliability. The sight of the $ falling over a long period of time, with bounces and recoveries that don't change the downward trend is far more than simply a drop in value!The $ is steadily weakening, but more than a drop in the $' international value is happening here. The loss of confidence is in the $ is accelerating each time it slips one or more percent on a persistent basis, with small short recoveries being seen in the midst of this decline. How important is this loss of confidence? Critical for it precedes policies, which long-term will lessen the role of the $ to one of the world's top 5 currencies.Growing surplus holders don't want to dump the $ for fear of losing value in the remaining ones in their portfolio, but don't think that a dumping of the $ is what it will take to remove it from the position of principal global currency. All realize that it is the knowledge of the declining value of the $ that will bring on a major toppling of that currency. So it is a choice of a steady ‘controlled' fall or a steep decline to disaster. To get perspective on the global scene what is the thinking out there?

Read the Full Article Here

The Subprime Mess is Just the Beginning of the Credit Crunch

Quote:

I hate to be the bearer of bad news, but the subprime flood—which has been declared contained over and over again—isn't contained yet. Newsweek's Daniel McGinn ably explains why the rate freeze is far from a panacea for all subprime borrowers. And a flood of new data indicate that the subprime woes may be a symptom—rather than a cause—of a broader economic malady. That awful smell in Midtown isn't from the horse-drawn carriages carrying tourists around. It's the distinctive odor of debt going bad.

I see it going down like this:

1 ) Massive mortgage defaults and attempt by the government to stanch the bleeding by printing more money

2 ) More devaluation of the dollar and the cascade from mortgage defaults to credit card defaults

3 ) Recession - 40% drop in home prices and another 25% drop in value of dollar

4 ) OPEC countries and china drop pegs to dollar, dollar drops another 30-40%

4 ) I move in with euros and buy a house on the beach in southern california for 100k euros

Okay, maybe it'll be a bit more than 100k euros, but not too much more

Read the Full Article Here

How China Could Crash The US Dollar on a Whim

Excerpt:

China has several economic “weapons” at its disposal for countering the US, ranging from the manipulation of its currency to the diversification of its burgeoning stock of forex reserves. It also has several less blunt options to choose from, such as enabling Chinese companies to compete more directly and effectively with US companies, and opposing the US in securing a domestic energy supply. On all of these fronts, the US is essentially being held hostage, since it has become so dependent on China as the world’s factory. Ultimately, it seems unlikely that China will deliberately butt heads with the US unless it is first provoked, but America should nonetheless be on its guard, since its economy hangs in the balance.

Read the Full Article Here

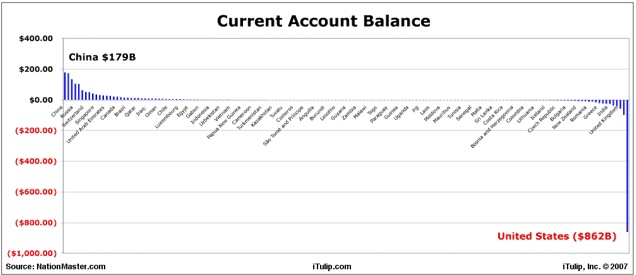

American Current Account Deficit

US Home Forclosures Nearly Double

Excerpt:

Foreclosure filings across the U.S. nearly doubled last month compared with September 2006, as financially strapped homeowners already behind on mortgage payments defaulted on their loans or came closer to losing their homes to foreclosure, a real estate information company said Thursday. A total of 223,538 foreclosure filings were reported in September, up from 112,210 in the same month a year ago, according to Irvine-based RealtyTrac Inc.

Read the Full Article Here

The Secrets of Intangible Wealth

Excerpt:

A Mexican migrant to the U.S. is five times more productive than one who stays home. Why is that?The answer is not the obvious one: This country has more machinery or tools or natural resources. Instead, according to some remarkable but largely ignored research—by the World Bank, of all places—it is because the average American has access to over $418,000 in intangible wealth, while the stay-at-home Mexican's intangible wealth is just $34,000. Intangible wealth are things like the trust among people in a society, an efficient judicial system, clear property rights and effective government. All this intangible capital also boosts the productivity of labor and results in higher total wealth. In fact, the World Bank finds, "Human capital and the value of institutions (as measured by rule of law) constitute the largest share of wealth in virtually all countries."

Read the Full Article Here

Britons Withdraw Billions in Bank Run

Excerpt:

Shares in one of Britain's largest lenders tumbled another 30 percent Monday as customers, driven by fears of insolvency, made run on the bank and withdrew billions.

Northern Rock's problems came against the background of signs of cooling in Britain's booming housing market.In an interview published Monday in The Daily Telegraph, former U.S. Federal Reserve Board chairman Alan Greenspan warned that Britain was susceptible to some of the problems now roiling the U.S. real estate market. "Britain is more exposed than we are in the sense that you have a good deal more adjustable-rate mortgages," he said.

Read the Full Article Here

Up to 40% of the Gain in US Manufacturing Output Since 2003 is Phantom GDP?

Excerpt:

Since 2004 I have written a number of articles pointing out that offshoring is really labor arbitrage and that if offshoring had the mutual economic benefits associated with free trade, there would be US employment growth in export and import-competitive industries. Instead, employment in these industries has declined in the US but grown remarkably in Asia. In the 21st century the US economy has been able to create net new jobs only in nontradable domestic services, such as waitresses and bartenders and health and social services. Moreover, the growth in productivity and GDP attributed to the US economy were inconsistent with the stagnant real incomes of Americans. Somehow productivity and GDP were growing strongly, but it wasn’t showing up in the incomes of Americans.

Business Week’s June 18 cover story by MIchael Mandel explains the problem identified by Houseman. Economist Matthew J. Slaughter, a proponent of offshoring, says: “There are potentially big implications. I worry about how pervasive this is.” Business Week says the implications are big. The cover story estimates that 40% of the gain in US manufacturing output since 2003 is phantom GDP.

Read The Full Article Here

Useful Index

See An Up-to-Date Chart Here

US Heads for Recession as Foreign Investors Rush for the Exit from US Dollar Holdings

Excerpt:

The days of the dollar as the world's “reserve currency” may be drawing to a close. In August, foreign central banks and governments dumped a whopping 3.8% of their holdings of US debt. Rising unemployment and the ongoing housing slump have triggered fears of a recession sending wary foreign investors running for the exits. China, Japan and Taiwan have been leading the sell off which has caused the steepest decline since 1992.

Read the Full Article Here

US Dollar Vulnerable to Interest Rate Cut, China Dumping US Bonds

Excerpt:

Speculators, investors, and central bankers have figured out that the US government and the Bernanke Fed will not protect the dollar - not when millions of Americans are having trouble making their mortgage payments. The US money supply is increasing - nearly five times faster than GDP growth. And now, fearing a Japan-style deflation, the Fed is likely to cut rates later this month.The Chinese have one of the largest dollar piles in the world.“Is China quietly dumping US Treasuries?” asks Ambrose Evans-Pritchard in the English press.“A sharp drop in foreign holdings of US Treasury bonds over the last five weeks has raised concerns that China is quietly withdrawing its funds from the United States, leaving the dollar increasingly vulnerable.”

Read the Full Article Here

Real US Inflation at 15%?

Excerpt:

"In 1983, the Bureau of Labor Statistics [BLS] was faced with an awkward dilemma. If it continued to include the cost of housing in the Consumer Price Index, the CPI would reflect an inflation rate of 15%, thereby making the country's economy look like a banana republic. Worse, since investors and bond traders have historically demanded a 2% real return after inflation, that would mean that bond and money market yields could climb as high as 17%."Yikes! What to do, what to do, what to do whattodowhattodo? "The BLS's solution was as simple as it was shocking: exclude the cost of housing as a component in the CPI, and substitute a so-called 'Owner Equivalent Rent' component based on what a homeowner might 'rent' his house for." Hahaha! The government resorts to lying! "Wow! Why didn't we think of this before?" they are heard to ask among themselves. Fortunately for the government, it worked. "The result of this statistical sleight of hand was immediate and gratifying," Mr Hardaway writes, "for the reported inflation index quickly dropped to 2%"

Read the Full Article Here

Another Huge Bet Placed on the Market Tanking

Read a synopsis of the 2 big trades here by a guy on craigslist that likes to type in capital letters.

The Fed Won't Help the Working Class

Excerpt:

Besides having created the mortgage-liquidity nightmare, Greenspan and the Fed can also chalk up another accomplishment: inflation. Inflation is so serious that it has more than wiped out any income gains coming to the majority of families in the past seven years.The New York Times reports that "Americans earned a smaller average income in 2005 than in 2000, the fifth consecutive year that they had to make ends meet with less money than at the peak of the last economic expansion, new government data shows. While incomes have been on the rise since 2002, the average income in 2005 was $55,238, still nearly 1 percent less than the $55,714 in 2000, after adjusting for inflation, analysis of new tax statistics show."

Read the Full Article Here

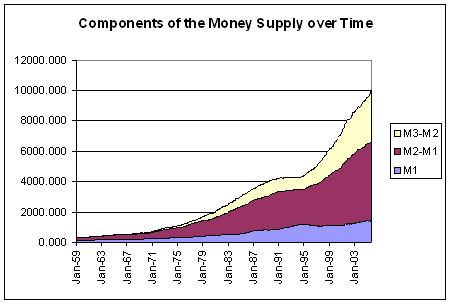

Money Supply 101

M1 — Measure of the U.S. money stock that consists of currency held by the public, travelers checks, demand deposits and other checkable deposits including NOW (negotiable order of withdrawal) and ATS (automatic transfer service) account balances and share draft account balances at credit unions.

M2 — Measure of the U.S. money stock that consists of M1, certain overnight repurchase agreements and certain overnight Eurodollars, savings deposits (including money market deposit accounts), time deposits in amounts of less than $100,000 and balances in money market mutual funds (other than those restricted to institutional investors).

M3 — Measure of the U.S. money stock that consists of M2, time deposits of $100,000 or more at all depository institutions, term repurchase agreements in amounts of $100,000 or more, certain term Eurodollars and balances in money market mutual funds restricted to institutional investors.

Home Prices Versus Median Wages

See any similarities between these 2 graphs?

The Crash of 2007-2008

Amazingly, some commentators have been asking “if the monetary crisis will affect the producing economy,” and whether a recession lies ahead. In reality, the U.S. producing economy has been in a recession for the last year. This is shown most clearly by the decline in M1, the portion of the money supply immediately available to people for making purchases.

Read Full Article